We’re living in very strange times. We’ve been plunged into a new paradigm of living and no one quite knows what to expect next, not even our top experts. Now that many nations have apparently passed the peak of this pandemic, economic recovery is at the forefront of efforts. The question is: How will we navigate the post-COVID-19 era? Is there a new normal, or just a constantly changing landscape? How have buying habits and consumer behavior changed, and are these trends that will continue for the foreseeable future? Nothing is certain, but we can glean some insights into how people react and change with such uncertainty through search and buying data.

Our goal as businesses isn’t to take advantage of society at large during a crisis. Our goal is to serve people’s needs and supply what they demand. These demands have certainly shifted in ways expected, and in some more surprising directions. We’ll likely see an even further (trends were already going in this direction) transparent, user friendly and customer-driven approach; companies need to win over clients with showing they do in fact care. So let’s look at what has changed over the past two months and what we might expect moving forward. The longer our self-isolation continues, the more likely it is that current buying habits will persist to a certain extent.

Google’s April 27th report shows that first and foremost, people are interested in keeping up to date with lockdown restrictions, re-opening of businesses and institutions, and generally keeping themselves informed. Secondly, and unsurprisingly, we’re seeking financial security as searches for unemployment benefits and furlough claims have shot up. In third place, we have searches related to physical fitness and mental well being.

What does this data tell us? Well if we refer to Maslow’s Hierarchy of Needs, we see that since most people have their physiological needs met (air, water, food, shelter, etc.), our next level is the need for safety and stability. Hence the above search trends related to knowledge, employment and health. So what about buyer sentiment moving forward? How are we feeling about spending?

According to a recent EY Future Consumer Index survey:

- 42% of respondents believe that the way they shop will fundamentally change as a result of the COVID-19 outbreak.

- 34% of consumers indicate that they would pay more for local products, 25% for trusted brands and 23% for ethical products.

‘These new consumer segments, detailed in the Index, could emerge post-COVID-19 and be summarized as: “Keep cutting” (13.1%), “Stay frugal” (21.7%), “Get to normal” (31.4%), “Cautiously extravagant” (24.7%) and “Back with a bang” (9.1%).’

These numbers indicate that while buyers are cautious now, many desire to return to pre-pandemic norms. Obviously there are serious factors at play regarding different industries. Compare travel to online learning, for example. Now let’s explore online search trends and buying during the height of the pandemic.

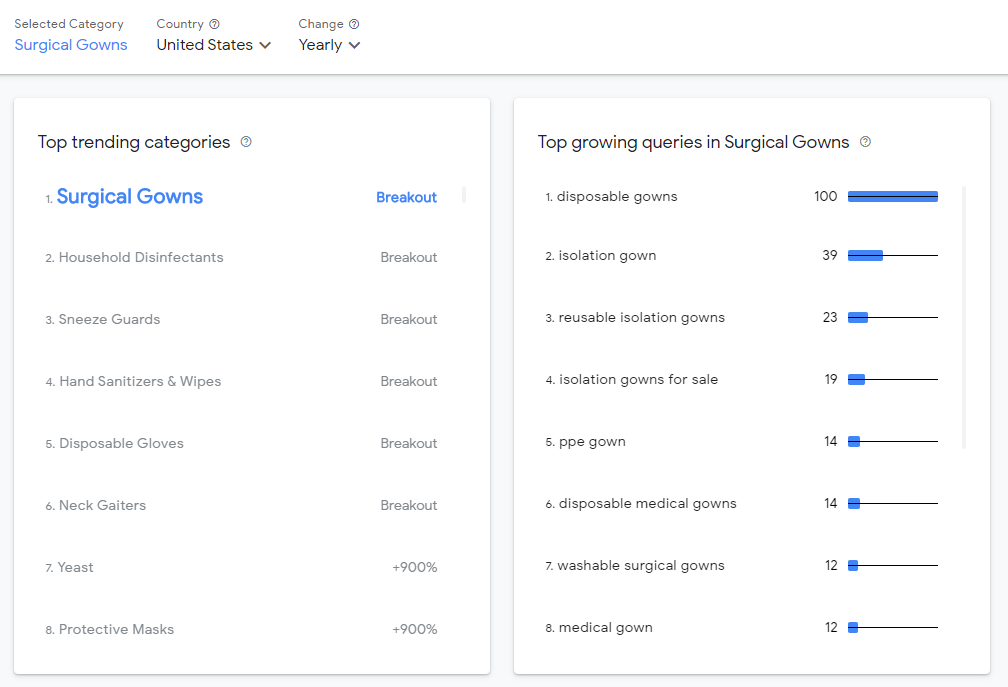

Here are the breakout search terms over the last year, which aside from yeast are all related to personal safety during COVID-19.

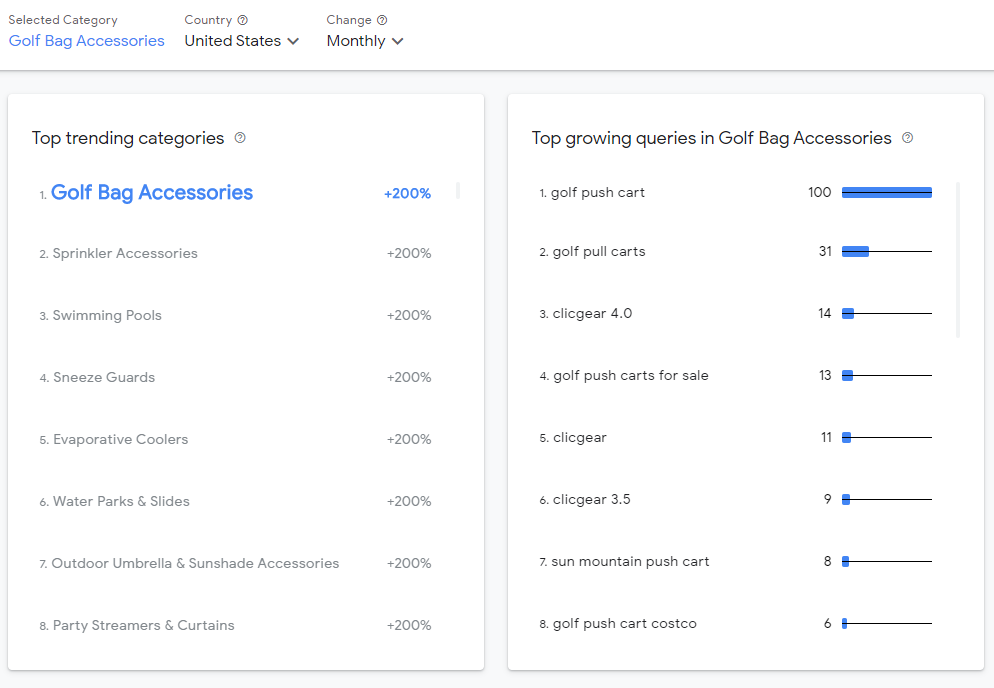

Now, compare these monthly top searches for May. People are now prepping for summer, and possibly spending their summer vacations in their own backyards. These are typical pre-summer search terms but the volume has noticeably shot up.

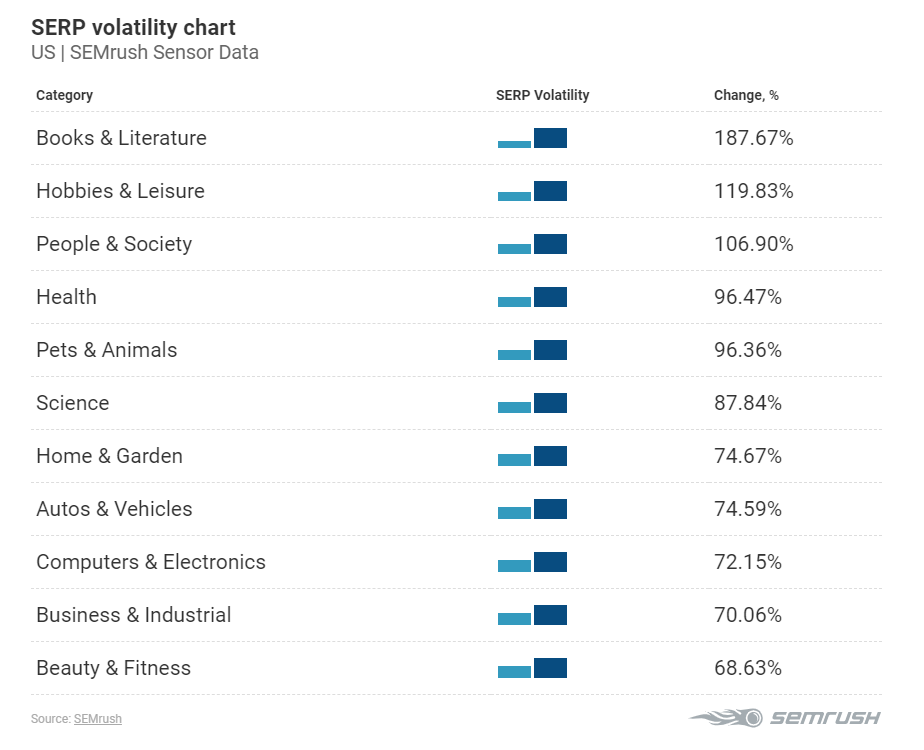

So what have people been searching for and buying during lockdown? The trend towards knowledge and leisure means we’re interested in improving our skills and, well, being entertained. Source: Semrush

One thing is for sure: the trend towards online buying will surge. Whether or not we return to brick and mortar retail functioning pre- COVID 19, those who resisted online shopping before will now accept its comfort and ease, especially since 52% of buyers say they’re practicing social distancing. If your business hasn’t yet put resources towards online offerings, including pick up order, now is definitely the time.

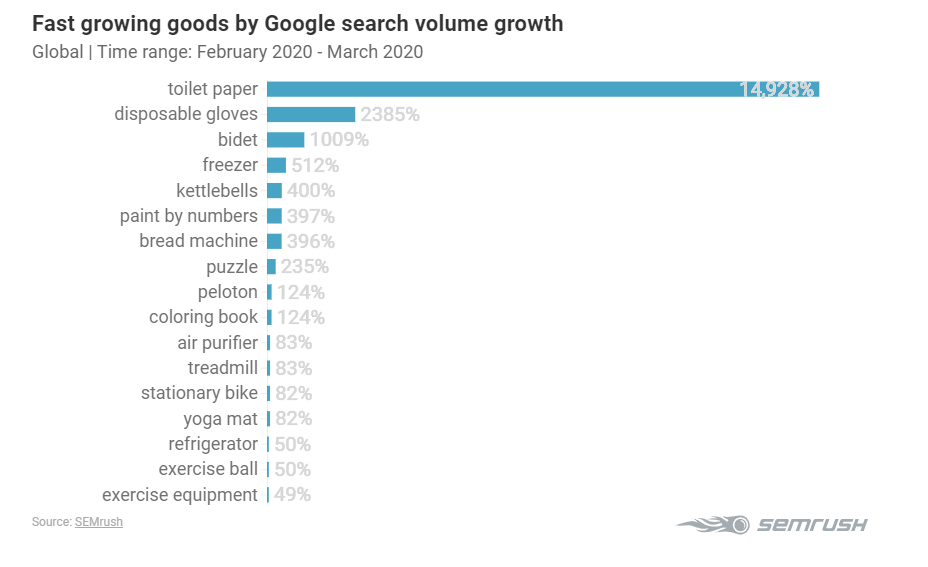

And what were the top products being searched for in March and April? What has changed as we’re now in May?

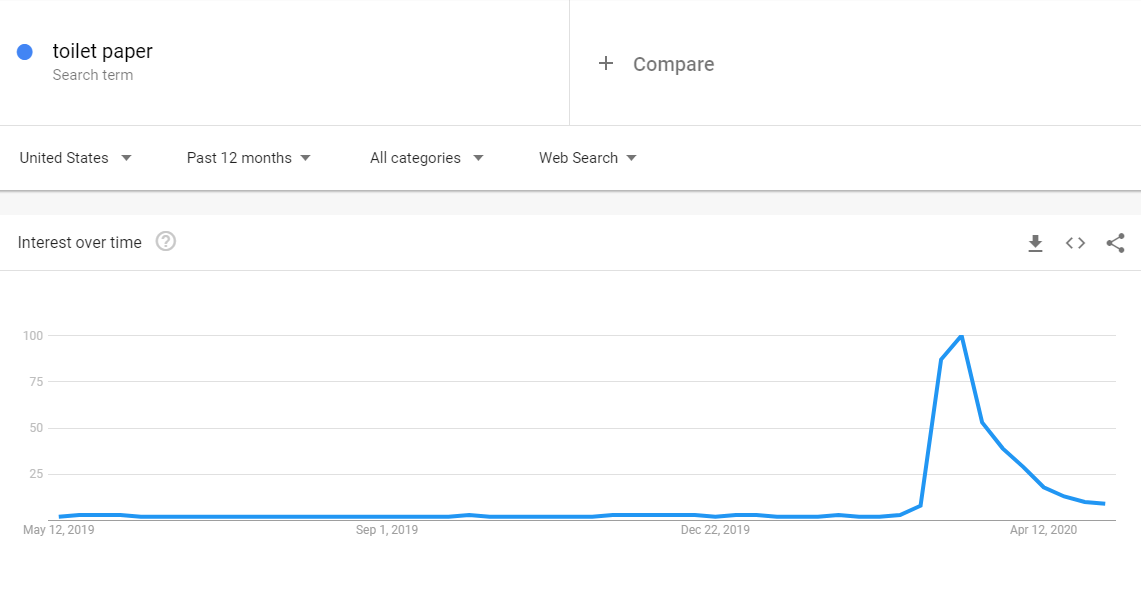

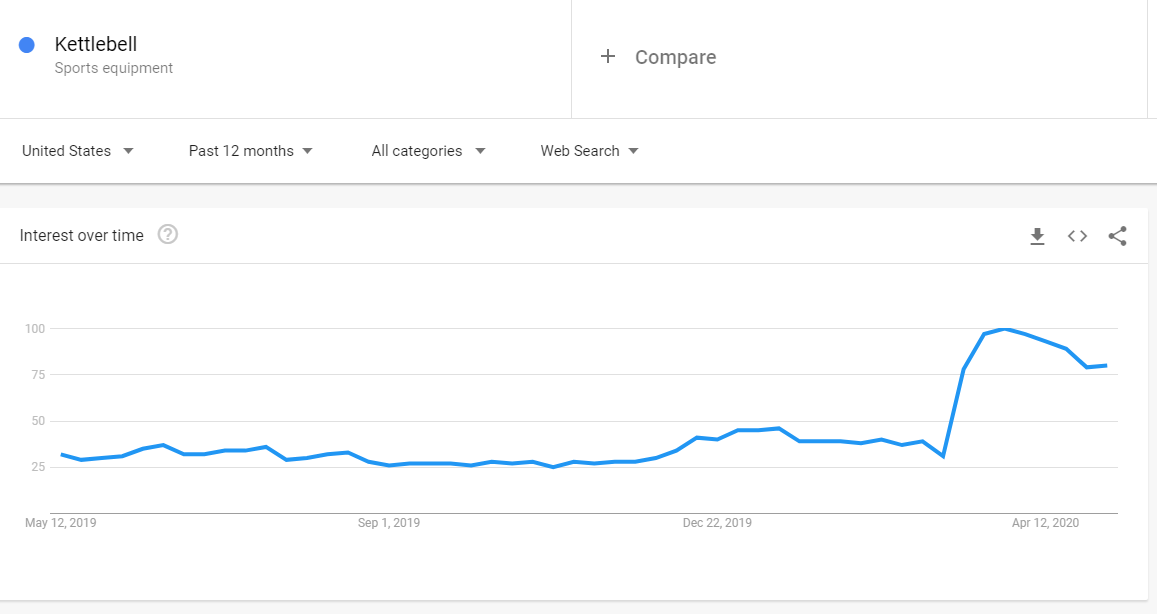

Toilet paper being first is a bit disconcerting (and bidets? In case we have a toilet paper shortage?) but the other entrants lean towards exercise and other ways of passing time at home.

It was predictable that toilet paper wouldn’t stay atop the list.

Kettlebells saw a spike due to their ability of giving a full-body workout in a compact, one piece of equipment. Interest remains high.

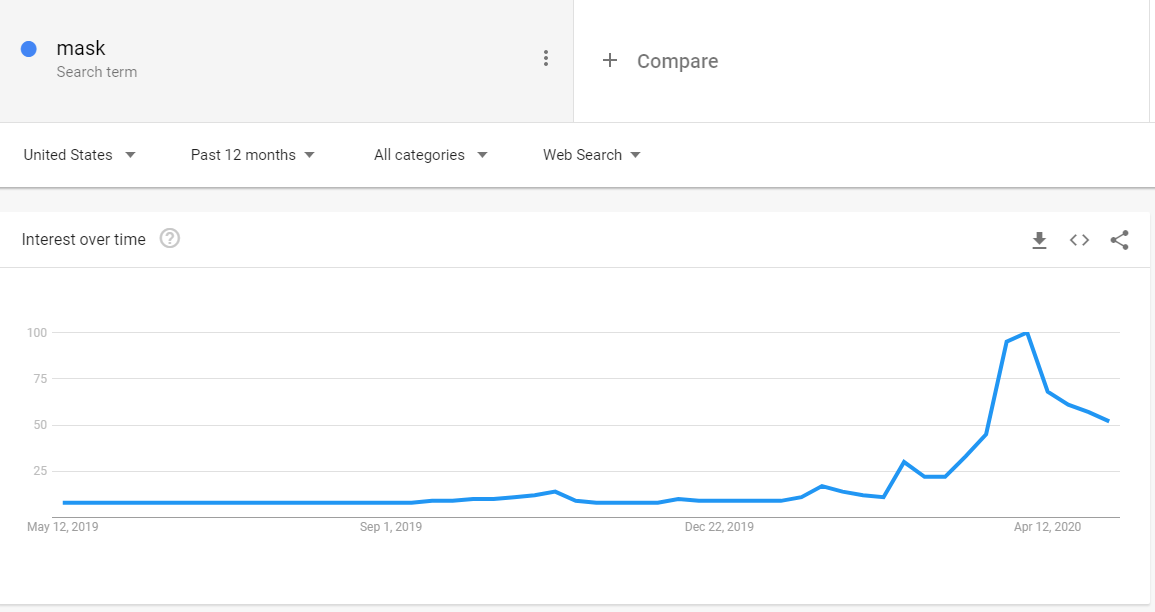

Masks saw an uptick for obvious reasons but saw a quick drop as well. Will they continue to be a sought after item? It’s hard to say due to conflicting advice from health professionals on whether masks are effective or not.

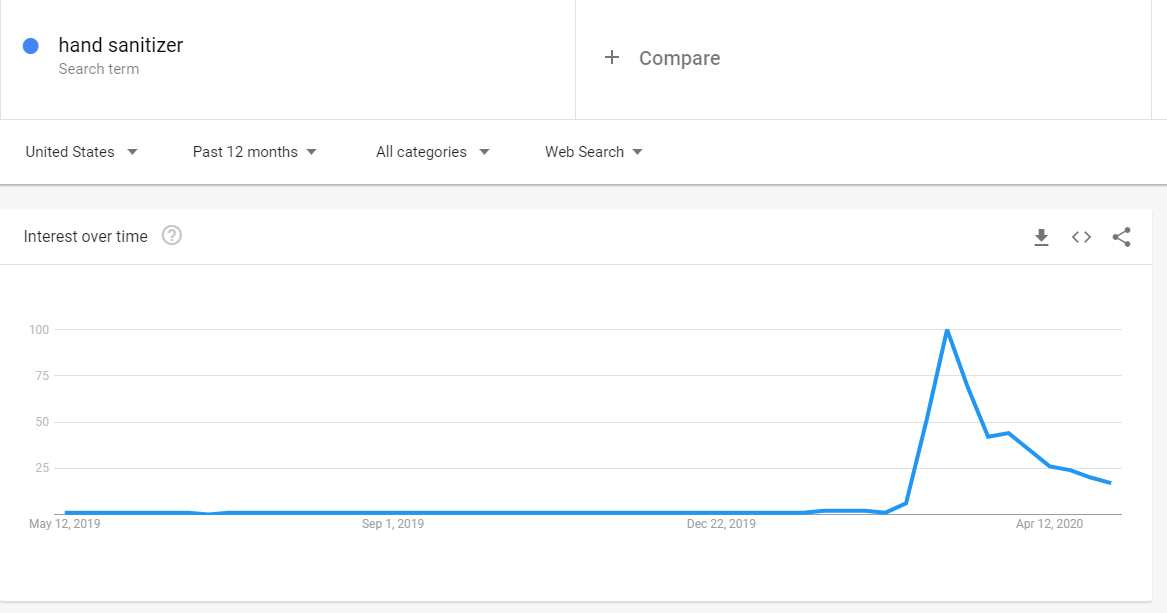

Along with masks, hand sanitizer was wildly popular and is almost back down to its pre-COVID-19 levels. This is surprising as one would think sanitation measures during an ongoing pandemic would continue.

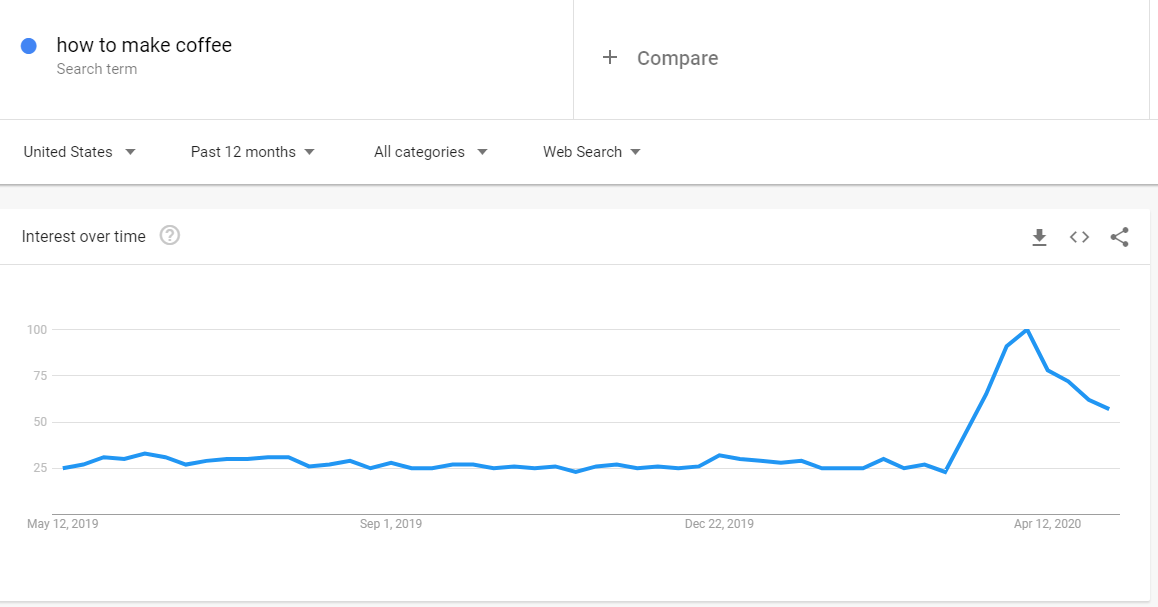

Besides products, people have been searching for ‘How-tos’ such as how to make coffee, showing that a lot of us apparently have never made coffee at home?

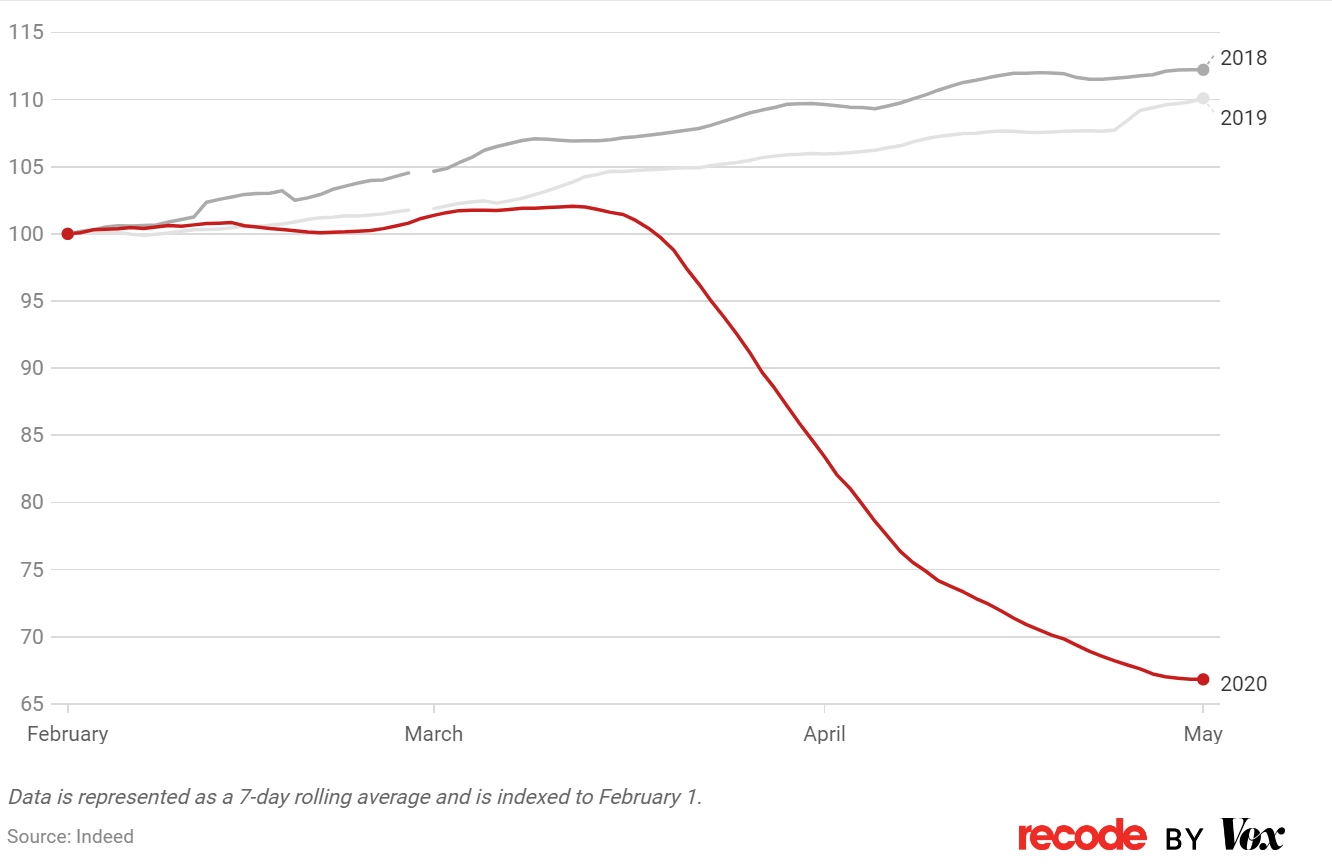

What about employment? Well according to data from Indeed.com, job postings are down 40% from this time last year. This has serious implications and doesn’t show much confidence in a quick recovery by companies.

Source: Vox

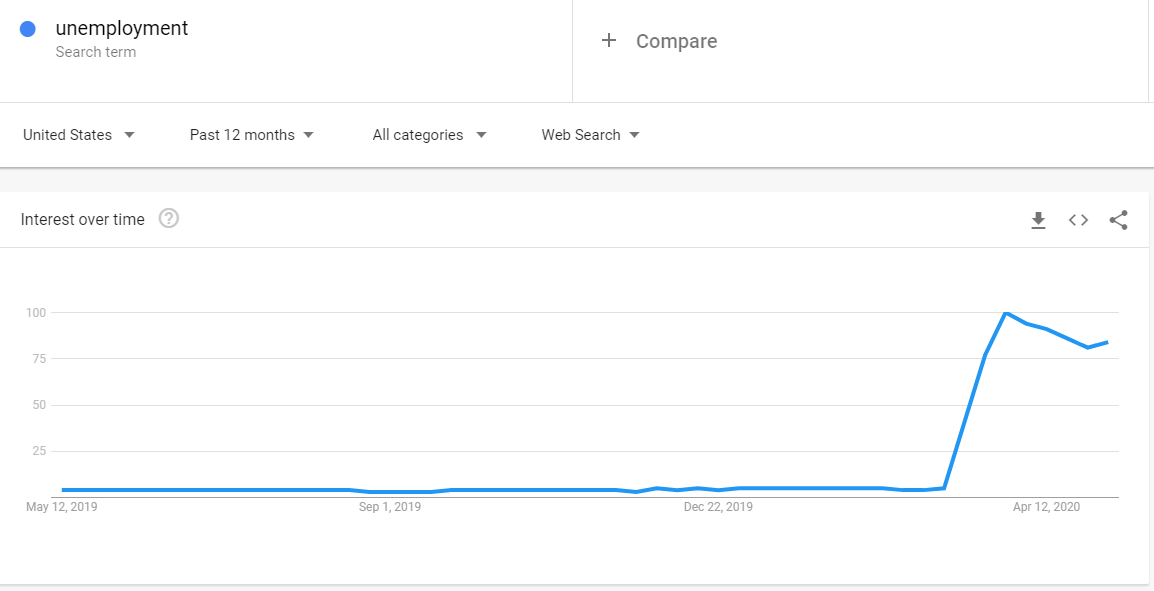

And unfortunately searches for unemployment have shot up and remained high. Will employees be rehired once ‘shelter in place’ restrictions are lifted? 20.5 million jobs have been lost bringing unemployment up to nearly 15%. 18 million of those jobs cut were considered temporary, however. Many of these jobs will likely return, albeit in a new form. Some minimum wage workers are actually earning more from unemployment than they did while employed.

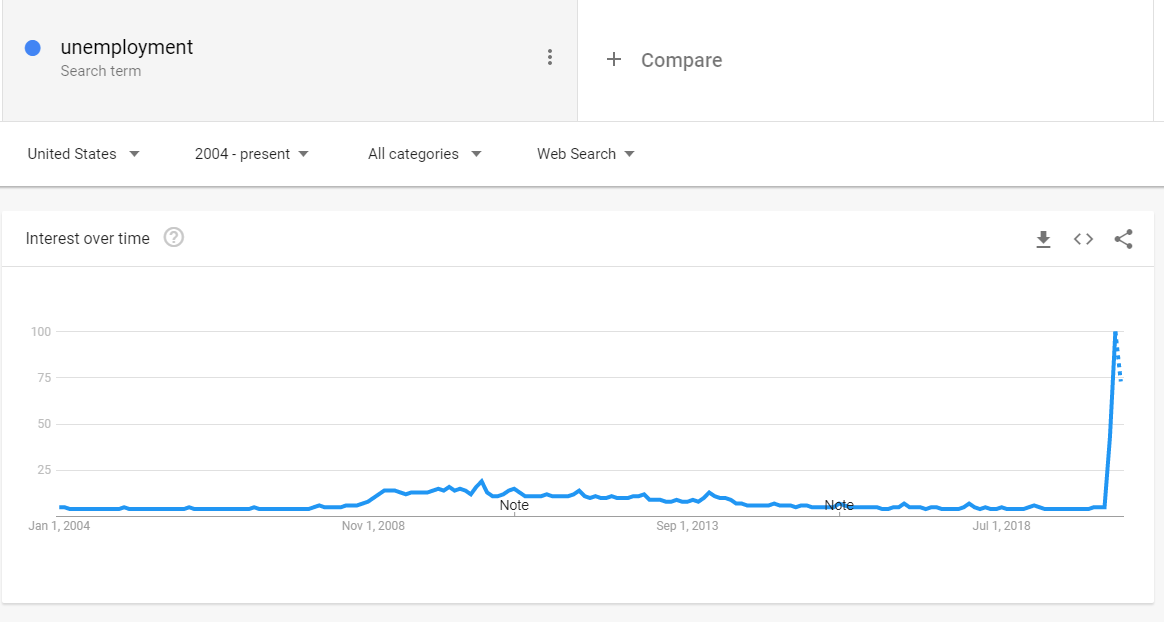

But here’s the scary part. Compare searches for unemployment during the 2008 recession and COVID-19. Now it could be due to more people being online in 2020 and a general hysteria over the uncertainty moving forward, however, the spike is shockingly steep.

April data shows a 16.4% drop in retail sales (including online) and while it’s likely the low point, some businesses might make the long climb back up. Estimates point towards 100,000 US retail locations closing by 2025. J.Crew and Neiman Marcus have both filed for bankruptcy protection. A telling sign, indeed.

The good news? Foot traffic in shopping malls is on an upward trend, according to Placer.ai, who tracks retail activity via smartphones. It’s nowhere near pre-COVID-19 levels but we are seeing progress. It’s likely that we’ll only fully recognize the full impact of this pandemic in months and even years to come, yet from data collected, there is certainly a willingness to begin spending. Slowly, and probably very slowly. Businesses need to diversify, become lean, and cut the fat from their operations. Moving online is one way for some. For others, where a physical location is absolutely necessary, creativity and collaboration in an ever-changing landscape are musts.